|

I often get asked if dental insurance is worth it. I recommend that most employers offer dental insurance. Unlike medical, life, and disability insurances which provide financial protection to cover catastrophic health issues, dental provides a different type of benefit. In some ways it can be thought of as an employee perk to: 1. incentivize good oral health 2. streamline the tedious process of finding and utilizing dental care 3. provide good financial protection against the cost of dental care Here's a solid video from CNBC on the topic:

0 Comments

The IRS has released 2022 limits for HSA, HSA, etc.:

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/irs-benefits-contributions-limits-chart-2022.aspx Big changes in the realm of healthcare pricing transparency coming to consumers effective January 1, 2022.

For healthcare services scheduled at least three business days in advance, providers must give the participant’s plan a good faith estimate of anticipated charges. The era of "buy now, we'll tell you how much it will cost later" is hopefully coming to an end. https://hallbenefitslaw.com/greater-price-transparency-advanced-explanation-of-benefits-requirements-coming-soon/ Some employers may consider a health premium surcharge for unvaccinated employees:

https://www.shrm.org/ResourcesAndTools/hr-topics/benefits/Pages/employers-ponder-health-plan-premium-surcharges-for-the-unvaccinated.aspx All Individuals, Insured Groups, and Self-Funded Accounts insured through a Blue Cross Blue Shield affiliate from February 7, 2008, through October 16, 2020 will be receiving a settlement notice with option to file a claim and participate in the pending class action lawsuit related to antitrust law violations.

https://www.bcbssettlement.com/ The American Rescue Plan Act of 2021 (“ARPA”) includes a 100% COBRA premium subsidy for periods of coverage occurring between April 1 and September 30, 2021, for certain eligible individuals. Details on how this will be administered have recently been published:

https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/cobra/premium-subsidy The American Rescue Act included a provision where the US taxpayers will pay 100% of the premium for COBRA participants from April 2021 through September 2021. This applies to employees who were laid off or hours were reduced so they lost health coverage. Exactly how the reimbursement will work for employers and COBRA administrators is TBD.

https://www.forbes.com/sites/ashleaebeling/2021/03/12/free-health-insurance-100-cobra-subsidy-questions--answers/?sh=20d7e8ea6660 The government has so far declined to provide Covid-19 liability protection for businesses. The first lawsuit against an employer is now being heard:

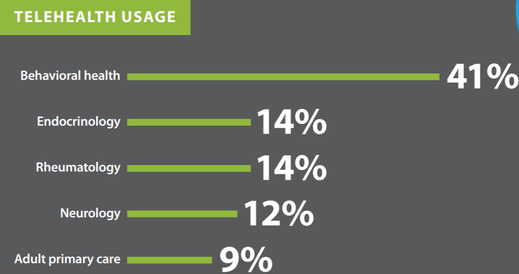

https://www.insurancejournal.com/news/national/2021/02/18/601676.htm CA AB 744 took effect on 1/1/2021 and aims to expand access to telehealth. Employees need to be made aware of telehealth benefits, particularly when it comes to behavioral/mental health:

https://www.calhealthplans.org/wp-content/uploads/2020/12/fact-sheet-telehealth-11-24-20.pdf The powerhouse Amazon-Berkshire-JPMorgan healthcare joint venture Haven has disbanding. The moral of the story might be that even with unparalleled financial resources and marketplace leverage to disrupt the current system, healthcare is complex and regional in nature and there is no silver bullet:

https://www.cnbc.com/2021/01/04/haven-the-amazon-berkshire-jpmorgan-venture-to-disrupt-healthcare-is-disbanding-after-3-years.html The No Surprises Act, signed into law on December 27, 2020 will provide additional consumer protections for out-of-network emergency care and to out-of-network care provided at in-network facilities starting in 2021:

https://www.natlawreview.com/article/surprise-medical-billing-protections-coming-participants-2022 Big changes for CA employers with between 5-49 employees. Beginning in January, an expanded California leave law will require employers with as few as five employees to provide up to 12 weeks of unpaid medical and family leave each year.

https://www.natlawreview.com/article/california-expands-family-and-medical-leave-law Some employees prefer and thrive in a work from home environment, but many do not prefer it and are being forced to due to Covid. Here's a good list of WFH struggles that companies may want to address:

https://www.visualcapitalist.com/top-struggles-of-remote-workers/ Thanks to all participants and volunteers who showed up to the 1st Annual VetCTAP Golf Tournament at Marine Memorial Golf Course on Camp Pendleton. I'm honored to be involved as a volunteer career coach and sponsor.

https://www.vetctap.org/ Insurance carriers and drug makers are often demonized as unjust profiteers of the US healthcare system. In practice, 20 out of 23 Obamacare Co-ops have failed. This is due to a variety of factors, but certainly provides evidence that the free market operates somewhat efficiently. Recently, California SB SB852 provides a path to get the State of California into the generic drug manufacturing business. It will be interesting to see if the state is successful in taking over the means of production for generic drugs.

https://www.msn.com/en-us/health/medical/california-rx-state-may-dive-into-generic-drug-market/ar-BB18L3ue Due to Covid, many remote employees are choosing to relocate their home address to a different geographic area. In some instances, this will impact their access to healthcare. Here's a summary of important considerations:

1. PPO members can usually find an in-network provider at their new geographic location. 2. HMO members often have emergency-only coverage outside of their local HMO network. If the change is more than a few weeks, members should consider switching to a local HMO medical group at their new locale(if possible) or switching to a PPO plan. 3. Most insurance carriers have expanded Telehealth options, providing access to care for HMO members outside of their geographic area. 4. Employees who "permanently" change their home address to another state(even if they are not planning on being there forever) will likely have income and payroll tax implications. It's a great idea to consult your payroll vendor and CPA if this comes up at your business. As expected due to Covid-related shutdowns and delay of standard care, Covered California insurance rates for 2021 will increase only an average of 0.6%. This is a solid early indicator for employers can expect in the broader group marketplace in California for 2021.

https://californiahealthline.org/news/covered-california-announces-record-low-rate-hike-for-2021/ Four executive orders were signed today to combat high Rx prices:

1. Directs federally qualified health centers to pass along massive discounts on insulin and epinephrine received from drug companies to certain low-income Americans. 2. Will allow State plans for safe importation of certain drugs, authorize the re-importation of insulin products made in the United States, and create a pathway for widespread use of personal importation waivers at authorized pharmacies in the United States. 3. Will prohibit secret deals between drug manufacturers and pharmacy benefit manager middlemen, ensuring patients directly benefit from available discounts at the pharmacy counter. 4. Ensures that the United States pays the lowest price available in economically comparable countries for Medicare Part B drugs. https://www.whitehouse.gov/briefings-statements/president-donald-j-trump-taking-action-lower-drug-costs-ensure-americans-access-life-saving-medications/ Improving the US Healthcare System: 6 GREAT IDEAS AND 5 NON-SOLUTIONSUS healthcare system provides the highest quality of care on the planet. Our system has fully harnessed the power of free market economics for innovation and efficiency, but is still subject to systemic barriers. San Diego in particularly has amazing systems including Scripps, UCSD, Sharp, and others. Access to care and cost are a separate issue. In my career working as an insurance broker since 2005, I am often asked what actions could be taken to improve access to care and cost.

Here are some good ideas and non-solutions, in my opinion. 6 GOOD IDEAS 1. Improve population health:

1. State-by-state limiting Rx copays:

The CA Department of Fair Employment and Housing has released a free training tool to help companies comply with SB1343. For companies with 5 or more employees, the training is due by January 1, 2021.

https://www.dfeh.ca.gov/wp-content/uploads/sites/32/2018/12/SB_1343_EmployerFAQ.pdf Most healthcare providers accept both Medicare and private insurance, and some also accept Medicaid/Medi-Cal. Private insurance provides the most lucrative reimbursements to doctors, hospitals, and Rx providers thus keeping the system afloat(profitable) and driving innovation. Here's a breakdown of the rates different insurance providers pay from one TX study:

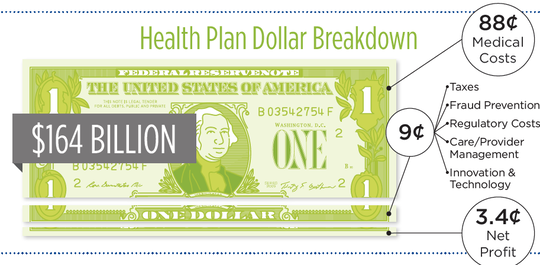

For Every $1 Paid by Medicare: Private Insurance: pays 115%-200% of the Medicare rate. Medicaid: pays 61%-81% of Medicare rate. Source: https://www.texmed.org/uploadedFiles/Current/2016_About_TMA/TMA_Publications/Texas_Medicine/Krause%20Table%205.pdf https://www.texmed.org/June16Journal/ Ever wonder where your insurance premiums go? Health insurer profit account for just 3.4% of your premium. Insurance companies have extremely high levels of transparency and regulation. Information can be found via

publicly available small group rates, 5500 filings for large groups, State Department of Insurance Filings, and ACA MLR reporting. Conversely, the 88% of premium spent on medical cost has very limited transparency and regulation: Rx costs, pharmacy benefit manager rebates, hospital costs, etc. https://www.calhealthplans.org/wp-content/uploads/2020/02/infographic-ca-health-care-dollar-02-05-20.pdf CA health insurance carriers have done their part in the Covid-19 crisis by waiving testing costs, advancing claims payments, enhancing telehealth, and relaxing Rx/pre-authorization protocols.

https://www.calhealthplans.org/wp-content/uploads/2020/04/fact-sheet-cahp-plans-to-respond-to-coronavirus-04-18-20.pdf Follow up to my post from 3 weeks ago regarding the direction of health insurance rates. Suspension of elective care procedures will outweigh COVID-related care and will drive low increases or even rate reductions in the near term in most areas:

"Earlier this month, UnitedHealth Group CEO David Wichmann told analysts that cost reductions so far are outstripping expenses for COVID-19 and that revenue is up compared with the previous year" https://khn.org/news/health-insurers-prosper-as-covid-19-deflates-demand-for-elective-treatments/ |

|

© 2024 ACTIVEWAVE INSURANCE SOLUTIONS

CA Insurance License 0F03547 Privacy Policy |