|

Sharp HealthCare employees have recently voted to unionize.

The move may help ensure adequate staffing levels, adequate pay, and may help reduce employee burnout which is a major issue in the nursing field. The move may also ultimately put upward pressure on health insurance rates in San Diego. https://www.msn.com/en-us/news/us/2000-healthcare-workers-at-sharps-san-diego-campus-vote-to-unionize/ar-BB1qf5SI

0 Comments

How will the Supreme Court's Chevron Doctrine decision impact the US healthcare system?

Back in 2009, critics of Affordable Care Act(Obamacare) argued that too many regulations were to be decided in subsequent months/years by government agencies. In coming months, expect more legal challenges to be brought in the court system for regulations not specifically outlined in the language of the ACA and other laws that regulate healthcare. For the ACA in particular, many regulations are complex and not clearly stated in the law itself, so legal challenges could be disruptive to the status quo. www.medscape.com/viewarticle/supreme-court-ruling-overturning-chevron-could-paralyze-2024a1000c5h?form=fpf When searching for a primary care physician, you will usually see the letters MD or DO next to the doctor's name. This article provides a solid breakdown of the difference in training these two types of designations receive.

MD: Allopathic medicine focuses on diagnosing and treating the patient’s symptoms directly. DO: Osteopathic medicine focuses on whole-body perspective which considers the full scope of the person’s overall health to promote well-being https://issuu.com/articles/46170689 Cigna + Oscar is exiting the California marketplace in 2025:

https://endpts.com/oscar-is-winding-down-its-small-employer-health-plans-with-cigna/ Many labor regulations which were originally created in states like California have now gone nationwide. The FTC recently released regulations banning non-compete agreements nationwide in most situations, mirroring rules that have been in place in California for decades.

https://www.sandiegouniontribune.com/business/story/2024-05-06/the-californiazation-of-federal-labor-rules In 2025 Blue Shield of CA is planning to switch its Rx manager to Mark Cuban’s Cost Plus Drug Company and Amazon Pharmacy. It will be interesting to see if this strategy delivers satisfactory customer service to members and reduces costs. CVS Health’s Caremark has been Blue Shield’s PBM partner for more than 15 years.

https://www.cnbc.com/2023/08/17/cvs-stock-blue-shield-of-california-drops-pbm-services.html UCSD Health has completed its acquisition of Alvarado Hospital Medical Center. Between this facility and Tri City Medical Center, UCSD Health is expanding its capacity in San Diego County outside the La Jolla main campus.

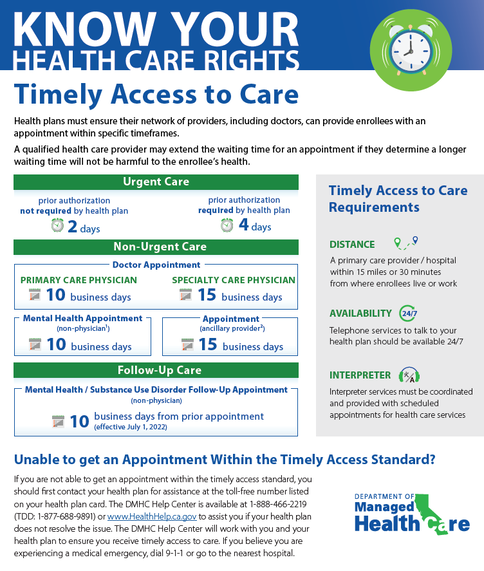

https://health.ucsd.edu/news/press-releases/2023-12-11-uc-san-diego-health-completes-acquisition-of-alvarado-hospital-medical-center/ PPO medical plans offer direct in-network access to a large variety of healthcare providers in most geographic areas. On a PPO plan, usually you can call around and get an appointment with a provider who has availability within 7 - 10 days or sooner for urgent health issues. You can take matters in to your own hands to find a provider who will see you.

HMO plans are more restrictive and require members to see your designated primary care primary care physician and get referrals for specialists, diagnostic tests, physical therapists, etc. As a consumer protection, the State of California has legal guidelines that HMO plans must follow. If your HMO is not providing timely access, this is a helpful document to reference. www.dmhc.ca.gov/Portals/0/Docs/DO/TAC_accessible.pdf Big news in North County San Diego. UCSD Health has announced a partnership with Tri-City Medical Center. UCSD will absorb Tri-City’s property, outstanding debt and staff, and will form a new governing board. It's unclear if an when the facility will be rebranded and become an in-network option for insurance plans which provide access to UCSD Health.

https://www.kpbs.org/news/local/2023/10/27/tri-city-medical-center-partners-with-uc-san-diego-health-to-expand-care Since the early days of the internet, physicians have used online resources to help guide effective care by providing information from clinical trials, medical specific websites like WebMD, and other webpages indexed by search engines. With the emergence of AI technology from Google and ChatGPT, access to the best information will continue to improve:

https://kffhealthnews.org/news/article/chatgpt-chatbot-google-webmd-symptom-checker/ As the Writers Guild and UAW strikes are dominating the headlines, healthcare workers are facing similar challenges in dealing with cost of living increases. Wage increases may be needed to maintain adequately staffed medical facilities, but will certainly increase health insurance premiums in the future.

Below is some more information on these 2 related topics: The CA legislature has approved a $25 minimum wage law for healthcare workers which is awaiting signature from the governor. https://www.latimes.com/california/story/2023-09-14/california-lawmakers-approve-25-per-hour-minimum-wage-but-not-without-a-fight Kaiser workers in CA and nationwide are preparing for a strike. https://www.msn.com/en-us/news/us/tens-of-thousands-of-kaiser-healthcare-workers-approve-possible-strike/ar-AA1gJSX9 As a trend, benefits administration systems with an Amazon-like benefits election experience are becoming more prevalent than human interactions like live open enrollment meetings and one-on-one conversations. While leveraging innovating technology is important, it is important for employers to consider the complexity of insurance benefits(and other important HR topics) and have a comprehensive strategy which provides access to deeper resources to help employees.

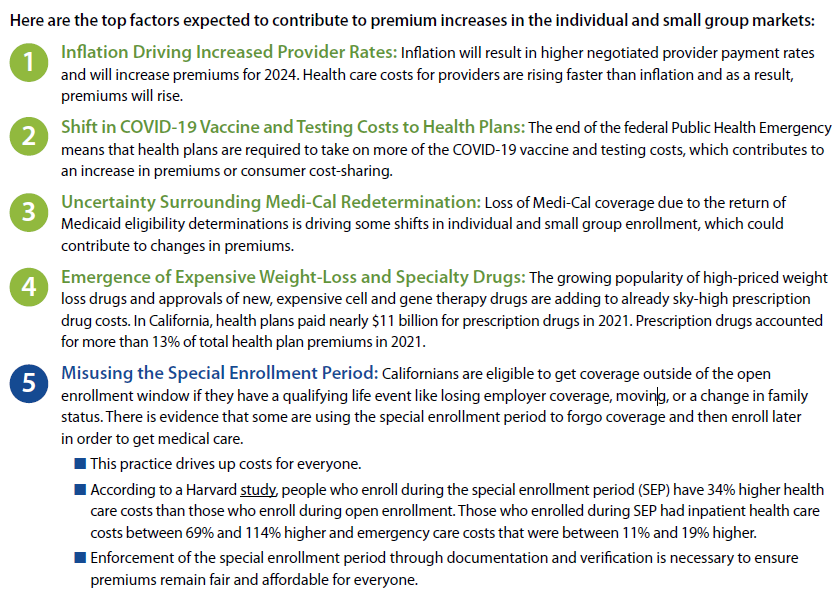

www.shrm.org/resourcesandtools/hr-topics/benefits/pages/hr-involvement-in-benefits-education-on-the-decline-optavise-report.aspx Interesting data on what drives health insurance premiums for 2023: Top Factors: 1. Inflation Driving Increased Provider Rates 2. Shift in COVID-19 Vaccine and Testing Costs to Health Plans 3. Uncertainty Surrounding Medi-Cal Redetermination 4. Emergence of Expensive Weight-Loss and Specialty Drugs 5. Misusing the Special Enrollment Period

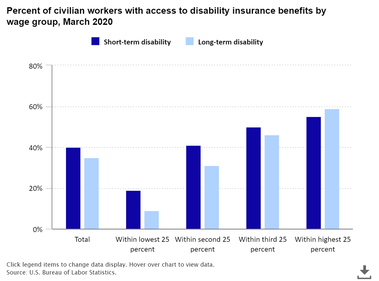

1 in 4 of today’s 20-year-olds will become disabled before they retire. Long term disability insurance is very important. If employees become unable to work, LTD provides cash payments(usually around 60% of income) to cover non-medical living expenses: housing, food, etc.

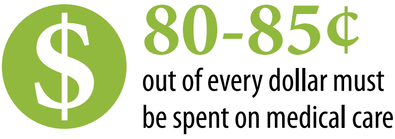

This chart provides a breakdown of US employees who have LTD coverage, broker down by income quartiles. A few interesting stats from the California Association of Health Plans :

-health plans spent 87 cents out of every health plan dollar, on medical care -health plans picked up 92.6% of the tab of the 25 most costly prescription drugs -Hospital care accounts for 31% of overall health care spending https://www.calhealthplans.org/wp-content/uploads/2023/01/fact-sheet-ca-health-care-dollar-01-04-23.pdf This is interesting: the NHS has tapped private industry managed care provider Centene(owner of Health Net and administrator for US Government programs medicare, medicaid, and TriCare) to administer medical practices in the UK, seemingly to gain operational and financial efficiencies:

https://khn.org/news/article/centene-under-siege-in-america-moved-into-britains-national-health-service/ Health-related benefits continue to top the list in terms of importance in the 2022 SHRM Survey:

www.shrm.org/hr-today/trends-and-forecasting/research-and-surveys/Pages/2022-Employee-Benefits-Survey.aspx Great vid from WSJ on how healthcare pricing functions and how the marketplace is changing: July 1, 2022 was a major milestone for healthcare pricing transparency. As of July 1, health insurers and self-insured employers must post on websites just about every price they’ve negotiated with providers for health care services, item by item. This is an important step for the free market healthcare system to thrive.

khn.org/news/article/health-insurers-price-transparency-public-rates-costs/ Bezos, Cuban, and now Newsom?

The State of California is exploring becoming a drug manufacturer. If enacted, Newsom's program will join Mark Cuban's Cost Plus and Amazon Pharmacy as big money entrants into drug manufacturing and distribution markets. More competition usually drives down prices. khn.org/news/article/california-wants-to-slash-insulin-prices-by-becoming-a-drugmaker-can-it-succeed/ www.markcubancostplusdrugcompany.com/ pharmacy.amazon.com/how-it-works Should Employers Force Workers to Take Time Off?

Here's a good article with arguments for both perspectives: https://www.shrm.org/hr-today/news/hr-magazine/spring2022/pages/should-employers-force-workers-to-take-time-off.aspx Unlimited PTO has become a popular option for companies due to easy administration, end of employment cost efficiency, and attractiveness to potential new hires. Balancing effective use and preventing overuse are important concepts to consider:

https://www.shrm.org/ResourcesAndTools/hr-topics/benefits/Pages/encouraging-employees-to-take-PTO-when-its-unlimited.aspx Pre-tax student loan repayments are becoming a larger part of the total benefits discussion. "Employers can provide up to $5,250 in student loan repayment benefits tax-free through 2025".

www.shrm.org/ResourcesAndTools/hr-topics/benefits/Pages/will-student-loan-repayment-at-long-last-be-a-game-changer.aspx Starting Saturday, private health insurers will be required to cover up to eight home Covid-19 tests per month for people on their plans. Americans will be able to either purchase home testing kits for free under their insurance or submit receipts for the tests for reimbursement, up to the monthly per-person limit.

https://www.cnbc.com/2022/01/10/home-covid-tests-to-be-covered-by-insurers-starting-saturday.html Some great ideas for a 2022 New Years Resolution:

https://www.healthline.com/nutrition/realistic-new-years-resolutions#4.-Get-more-quality-sleep |

||||||

|

© 2024 ACTIVEWAVE INSURANCE SOLUTIONS

CA Insurance License 0F03547 Privacy Policy |